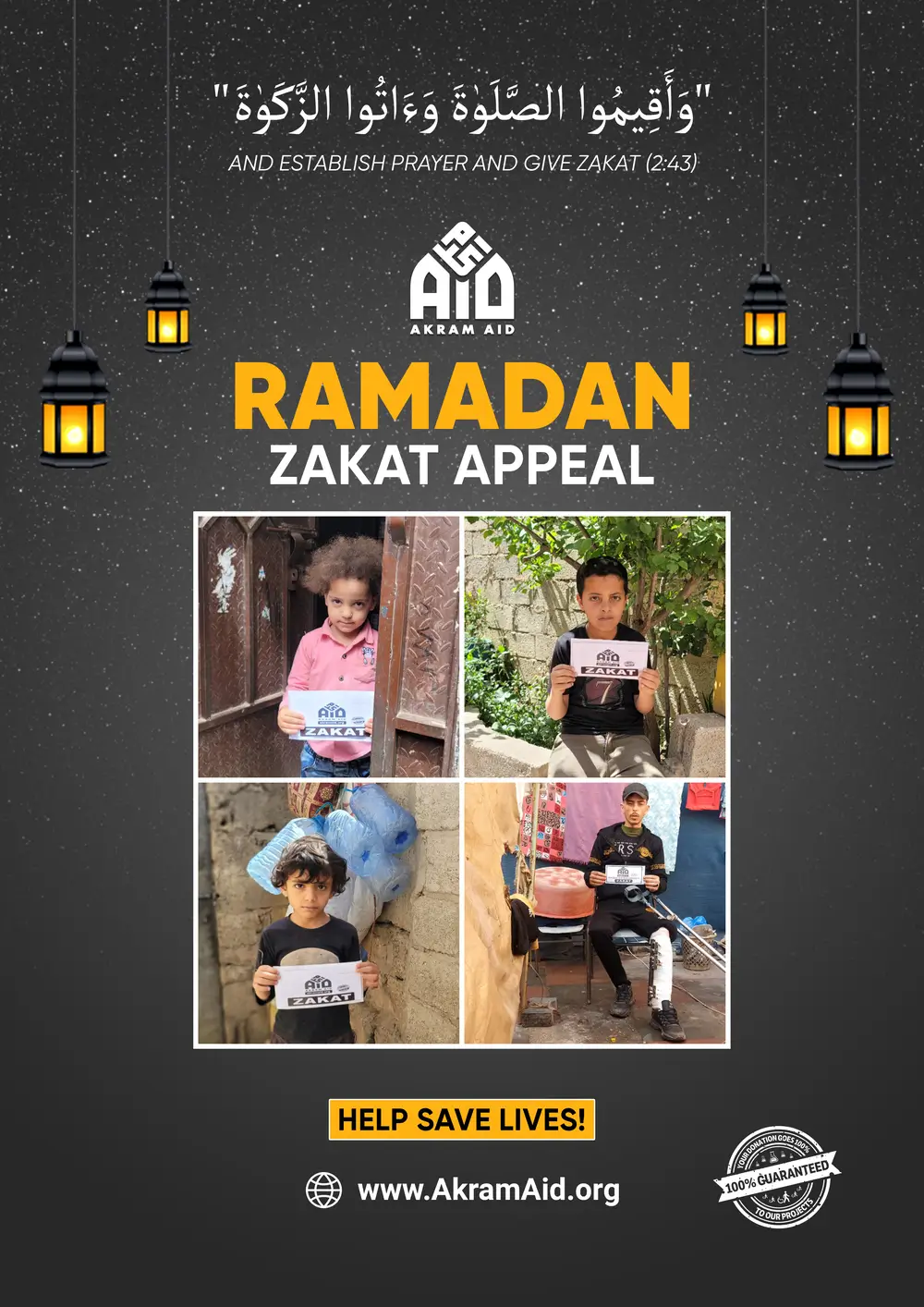

Ramadan

ZakatAppeal: Purify Your Wealth, Change Lives

Zakat is not charity. It is a duty. A right given by Allah ﷻ to those in need, and one of the five pillars of Islam.

This Ramadan Zakat Appeal is your chance to fulfil that obligation at the most blessed time of the year. A time when rewards are multiplied, intentions are honoured, and mercy is near. Your Zakat purifies your wealth and brings relief to someone who may struggle all year just to survive. For them, it can mean food, safety, and dignity. For you, it is obedience to Allah and purification of the soul.

What Is

Zakat in Islam?

Zakat is the third pillar of Islam and a compulsory act of worship for every eligible Muslim. It requires giving 2.5% of qualifying wealth to those Allah has made eligible to receive it.

The Prophet ﷺ said:

“Islam is built upon five: testifying that there is no god but Allah and that Muhammad is the Messenger of Allah, establishing prayer, paying Zakat, performing Hajj, and fasting Ramadan.”

— Sahih al-Bukhari, Sahih Muslim

Zakat is called Zakat because it purifies. It cleanses wealth from excess and the heart from greed. It restores balance between those who have and those who do not.

Allah says:

“Take from their wealth charity by which you purify them and cause them increase.”

— Surah At-Tawbah (9:103)

Neglecting Zakat is not a small matter. The Prophet ﷺ warned clearly of its consequences.

The Prophet ﷺ said:

“Any owner of gold or silver who does not pay its Zakat will be branded with it on the Day of Judgment.”

— Sahih Muslim

Giving through a Ramadan Zakat Appeal ensures your Zakat reaches those entitled to it, while you fulfil one of the most serious obligations in Islam at the most rewarding time of the year.

What Are

the Rules of Zakat?

Zakat is obligatory when your total wealth exceeds the Nisab threshold (the value of 87.48g of gold or 612.36g of silver). You’ve held that wealth for a full lunar year (hawl)

Zakat must be paid on:

Savings and cash

Gold and silver

Business stock and investments

Net rental income that has been saved

Agricultural produce and livestock, where specific Zakat rules apply

It must be distributed to the eight eligible categories mentioned in Surah At-Tawbah (9:60) — including the poor (fuqara), the needy (masakeen), and those in debt.

Zakat cannot be given to:

Wealthy individuals or those not eligible

For building mosques or general infrastructure

One’s direct ascendants or descendants (e.g., parents, children)

Correct calculation and correct recipients are both essential — especially during this Ramadan Zakat Appeal, when your intention and delivery must align with the sunnah.

How to Pay

Zakat – With Intention and Knowledge

Zakat begins with niyyah (sincere intention) and should be calculated carefully. The Nisab threshold is based on either:

87.48g

of gold

612.36g

of silver

Most scholars recommend using the silver value today to maximise impact for the poor. If your wealth — including savings, gold, investments, and business assets — has remained above the Nisab for one lunar year, Zakat is due at 2.5%. Use our Zakat Calculator to check eligibility and calculate the exact amount — so you can give with confidence, accuracy, and sincerity.

What are the

the Types of Zakat?

Zakat is categorised based on wealth or circumstance. The two main types are:

1. Zakat al-Mal

Annual Zakat on wealth (savings, gold, business, investments)

2. Zakat al-Fitr (Fitrana)

A fixed charity paid before Eid, on behalf of every Muslim under your care

Zakat al-Mal is the focus of this Ramadan Zakat Appeal — an obligation on wealth you’ve held for one lunar year above the nisab. Understanding the types of Zakat helps fulfil your duty correctly and ensures you give what is due in the eyes of Allah.

Why Give

Zakat in Ramadan?

Giving Zakat is a year-round obligation — but when given in Ramadan, its reward is multiplied beyond measure. It was during this blessed month that the Prophet ﷺ was at his most generous, and the hearts of the Ummah are softened toward giving.

Narrated Ibn ‘Abbas:

Allah’s Messenger (ﷺ) was the most generous of all the people, and he used to reach the peak in generosity in the month of Ramadan when Gabriel met him. Gabriel used to meet him every night of Ramadan to teach him the Qur’an. Allah’s Messenger (ﷺ) was the most generous person, even more generous than the strong uncontrollable wind (in readiness and haste to do charitable deeds).

— Sahih al-Bukhari

In Ramadan, every good deed carries an extra reward. And giving Zakat, a pillar of Islam, becomes an even greater act of worship. It’s a chance to support those fasting with empty stomach, those praying with hardship, and those who wait quietly for relief.

Let Your

Zakat Be a Mercy, This Ramadan

Your Zakat is a pillar — and a lifeline. This Ramadan Zakat Appeal is not just about fulfilling an obligation — it’s about restoring balance, offering relief, and seeking the pleasure of Allah ﷻ.

“And establish prayer and give Zakat, and whatever good you put forward for yourselves, you will find it with Allah. Indeed, Allah of what you do, is Seeing.”

— Surah Al-Baqarah (2:110)

Give with sincerity. Give with clarity. And trust that no wealth ever decreases by giving — only the soul increases.

Let Your

Giving Outlive the Month of Ramadan

Zakat may be your obligation — but compassion is your choice, every day.

The spirit of Ramadan calls us not only to fulfil duties, but to go beyond. To give without being asked. To care without being reminded. And to lift others even when no one is watching. You can continue the spirit of giving through:

Water Appeal – A source of Sadaqah Jariyah

Food Packs – Ongoing mercy for struggling families

Food Bank – Support right here in the UK

Gaza Emergency Appeal – Urgent relief for those in need

Yemen Emergency Appeal – Poverty in remote villages is stealing opportunity

Give. Pray. Serve. Let this month not end with Eid — but echo through the rest of the year in the form of sincere actions.

Frequently

Asked Questions

1. What is Zakat in Islam?

Zakat is the third pillar of Islam — a compulsory act of worship where Muslims give 2.5% of their qualifying wealth to those in need. It purifies your wealth and supports the poor, making it both a personal and social obligation.

2. Who has to pay Zakat?

Every Muslim who has reached puberty and possesses wealth above the Nisab threshold for one lunar year must pay Zakat. This includes savings, gold, business assets, and certain investments.

3. When should I pay my Zakat?

You can pay Zakat at any time of the year, but many choose Ramadan because the reward is multiplied. What matters most is that it’s paid once your wealth has remained above the Nisab for a full lunar year.

4. How do I calculate how much Zakat to pay?

You owe 2.5% of your qualifying wealth. You can use our Zakat calculator to work this out. Include cash, savings, gold, business stock, and deduct any immediate debts.

5. What is the Nisab threshold for Zakat?

Nisab is the minimum amount of wealth you must have before Zakat becomes obligatory. It is equal to the value of 87.48g of gold or 612.36g of silver. Many scholars recommend using the silver value to maximise support for the poor.

6. Who can receive Zakat?

Zakat can be given to the eight categories listed in Surah At-Tawbah (9:60), including the poor, the needy, those in debt, and travellers in hardship. It cannot be given to wealthy individuals, one’s direct descendants or ascendants, or for mosque construction.

7. Can I pay Zakat online?

Yes, paying Zakat online is valid and widely accepted. Just ensure your donation is handled according to Islamic rules and reaches eligible recipients — such as through a trusted charity like Akram Aid, which follows a 100% Donation Policy.

8. What’s the difference between Zakat and Sadaqah?

Zakat is an obligation, due annually on eligible wealth. Sadaqah is a voluntary charity that can be given at any time in any amount. Both are forms of worship, but Zakat has specific conditions and rules.